Schroder ISF Global Credit Income

Blending the right mix for changing investment climates.Why global credit income

For investors who want consistent, attractive income with risk managed in the current environment of low yields and higher volatility. A dynamic, unconstrained approach to investing across the global credit spectrum is key to achieving these objectives.

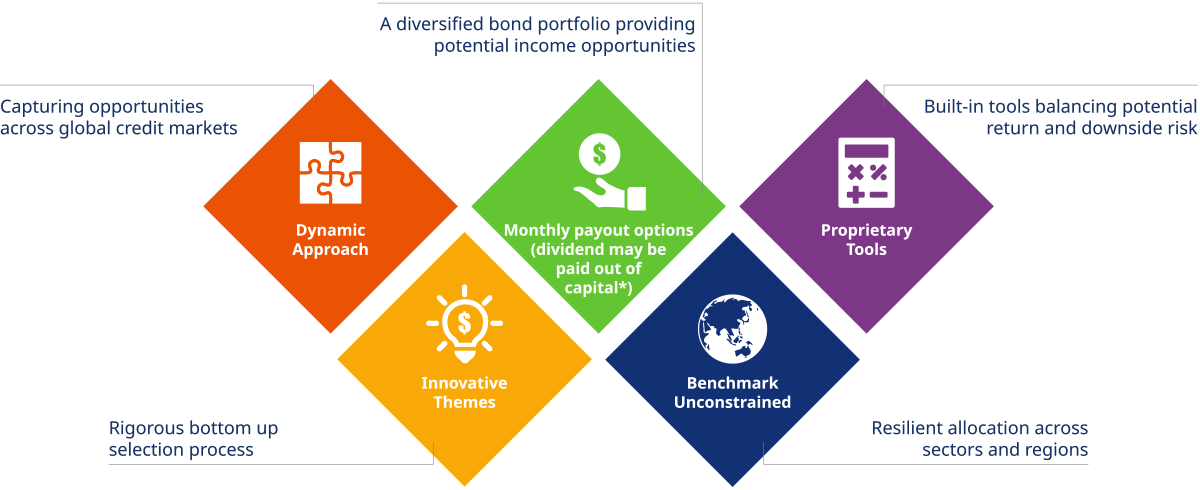

Key attributes of the fund

Think Income. Think Stability. Think Innovation.

Think Income

- Flexibility in investing across a wide range of bonds and credits

- Invest freely across the global bond spectrum

- The fund is managed with a benchmark unconstrained approach, we can invest across sectors and regions to capture attractive income opportunities and to help mitigating risk by diversification

- Providing monthly and fixed payout choices (dividend may be paid out of capital)*

- Bonds are popular investments for income seekers. Interest rates will likely remain low in the near future, a portfolio composed of various types of bonds could enhance potential returns with a sensible balance of risks. The fund’s primary target is to maintain sustainable and attractive payment, and intends to make a fixed payout of 4.75% p.a. (Applicable to A Dis USD and HKD classes)*

Think Stability

- We recognise that income seekers can be more sensitive to capital loss. A well-diversified bond portfolio built under dynamic asset allocation allows the fund to reduce risk in market downturns. Detailed downside risk analysis as well as management on currency and interest rate risk are incorporated with an aim to help mitigating potential loss and volatility

Think Innovation

In our credit selection process, we apply forward-looking themes like technological disruption, changing demographics and consumer trends. This approach helps identifying companies that are adapting well to change

Why Schroders for Global Credit?

Fixed income is generally considered as a relatively stable and dependable investment tool. Investing in the debt of companies, also called credit fixed income, can offer benefits. However, "credit" is a wide-ranging area. Before investing in this market, challenge yourself to see how much you know about credit investment by going thru the different levels of questions below:

Level 1 > Level 2 > Level 3

Level 1: Is credit different from equity?

When comparing credit to equity, equity has the lowest seniority in the payout order. To compensate for this additional risk, equity holders require a higher return on capital. Reflecting the higher risk, equity markets are relatively more volatile than credit market.

Various debt obligations can have different priority of payment corresponding to the seniority rankings. Senior secured debt top the ranking structure in the case of a default, with owners being paid off before other debtors.

Level 1: What is a corporate credit rating?

A credit rating is an evaluation of the creditworthiness of a borrower with respect to a particular debt or financial obligation assigned by external rating agencies. Moody’s, Standard & Poor’s and Fitch Ratings are three top agencies deal in credit ratings. Each credit rating agency has defined its own credit rating, the ratings generally lie on a spectrum ranging from the highest credit quality AAA on one end to default on the other. BBB- is the lowest rating of investment grade, while ratings below BBB- are considered as high yield.

Level 2: Benefits and challenges of investing in credit

Investors purchase bonds for several reasons: growth, income, liabilities matching, capital preservation and to reduce volatility. However, investors need to be aware of the two main risks involved:

- Corporate bonds generally carry a higher default risk than government bonds issued by developed countries. Defaults of underlying bond investments can reduce portfolio returns substantially. Active managers can employ rigorous credit research to maximize income without increasing potential risk significantly.

- Interest rate risk affects credit investing. When interest rates rise, bond prices generally fall.

Level 2: What is a credit spread?

A credit spread is the difference in yield between a credit instrument and a government bond of similar maturity. It is the risk premium charged by credit investors, for taking additional risk (liquidity risk, default risk, political risk and so on) of investing in a credit instrument.

Creditspread = the yield on corporate bonds - the yield on government bonds

The 4 characteristics of credit spreads:

- Measured in basis points (bps), with a 1% difference in yield equal to a spread of 100 basis points.

- Vary from one security to another based on the credit quality of the bond issuer.

- The higher the credit spread, the greater the risk level of the issuer is, and vice versa.

- General speaking, credit spreads fluctuations are commonly due to changes in economic conditions.

Level 3: What is affecting credit performance?

Credit spreads are a good barometer of credit market. Widening credit spreads indicate growing concern about the ability of corporate to service their debt while corporate bond prices fall and yields rise. Conversely, narrowing credit spreads indicate improving private creditworthiness. Corporate bond prices rise and yields fall. A number of factors affect credit spreads:

Idiosyncratic risk

Risk factors endemic to particular company or sector has an important impact on credit spreads over time. The impact could be mitigated by improving company fundamentals.

Economic growth

In economic expansion stage, earnings of most companies grow. This translates to a higher ability to repay debt, assuming debt levels stay constant. Default risk decreases, resulting in the narrowing of credit spreads. While the inverse happens in economic slowdown.

Economic cycle

Credit tends to perform in a more normalized framework during stages of stabilization and acceleration and could bear a higher default risk during stages of deceleration and slowdown.

Meet the fund manager

Julien Houdain is Head of Credit, Europe at Schroders, managing the credit strategy for Europe. He joined Schroders since the beginning of 2020 and is based in London. He has a great deal of experience managing complex global credit strategies, having previously been Head of Global Bond Strategies at Legal & General Investment Management.

We've got the solution for you

Our business is structured around a number of strategic capabilities, which combine to meet a variety of client requirements. Please visit our fixed income page to learn more about our intelligently crafted fixed income solutions.

Disclosures

Schroder International Selection Fund is referred to as Schroder ISF.

*For share classes with a general dividend policy, expenses will be paid out of capital rather than out of gross income. The amount of distributable income therefore increases and the amount so increased may be considered to be dividend paid out of capital. Share classes with a fixed dividend policy may pay out both income and capital in distributions. Where distributions are paid out of capital, this amounts to a return or withdrawal of part of your original investment or capital gains attributable to that and may result in an immediate decrease in the net asset value of shares.

All visuals shown are for illustrative purposes only and should not be viewed as a recommendation to buy or sell.

The fund has environmental and/or social characteristics within the meaning of Article 8 of Regulation (EU) 2019/2088 on Sustainability-related Disclosures in the Financial Services Sector (the “SFDR”). For information on sustainability-related aspects of this fund, please go to www.schroders.com.