Celebrating 60 years of investing in Australia

For six decades in Australia, our investment expertise and agility has helped us deliver consistent, long-term returns for our local clients. With one of Australia’s most experienced on-the-ground research teams, backed by over 220 years of compounded knowledge of global financial markets, our clients continue to benefit from our proven investment approach, deep wisdom and focus on investing beyond tomorrow — no matter which way the dance moves.

Discover what partnering with Schroders Australia, and being seriously invested, can do for you and your clients.

Local and global investment experience honed over decades

Schroders has had an investment team on the ground in Australia since 1964. It's grown considerably since then to cover Australian equities, fixed income and multi-asset investing, and offers a suite of global private markets strategies across private equity, private debt and real estate debt, among others. With many decades of experience under their respective belts, hear from the heads of our investment desks about the market experiences that have shaped them into the investors they are today, and what changes they predict in the years ahead.

Market reflections on Australian Equities

Head of Australian Equities, Martin Conlon, discusses the future for Western economies, and whether markets are at a point of extrapolation or inflexion.

Market reflections from the CIO

CEO and CIO of Schroders Australia, Simon Doyle, turns back the clock to discuss the market crises that have bookmarked his career, and what they taught him about managing risk.

Market reflections on Fixed Income

Head of Fixed Income, Stuart Dear, and Deputy Head of Fixed Income, Kellie Wood, describe what will be needed to be successful in today’s new economic regime.

Explore our corporate timeline

Schroders has enjoyed its fair share of proud moments over the years. This timeline traces some of the more memorable ones, from our origins in England through to the past 60 years of investing in Australia.

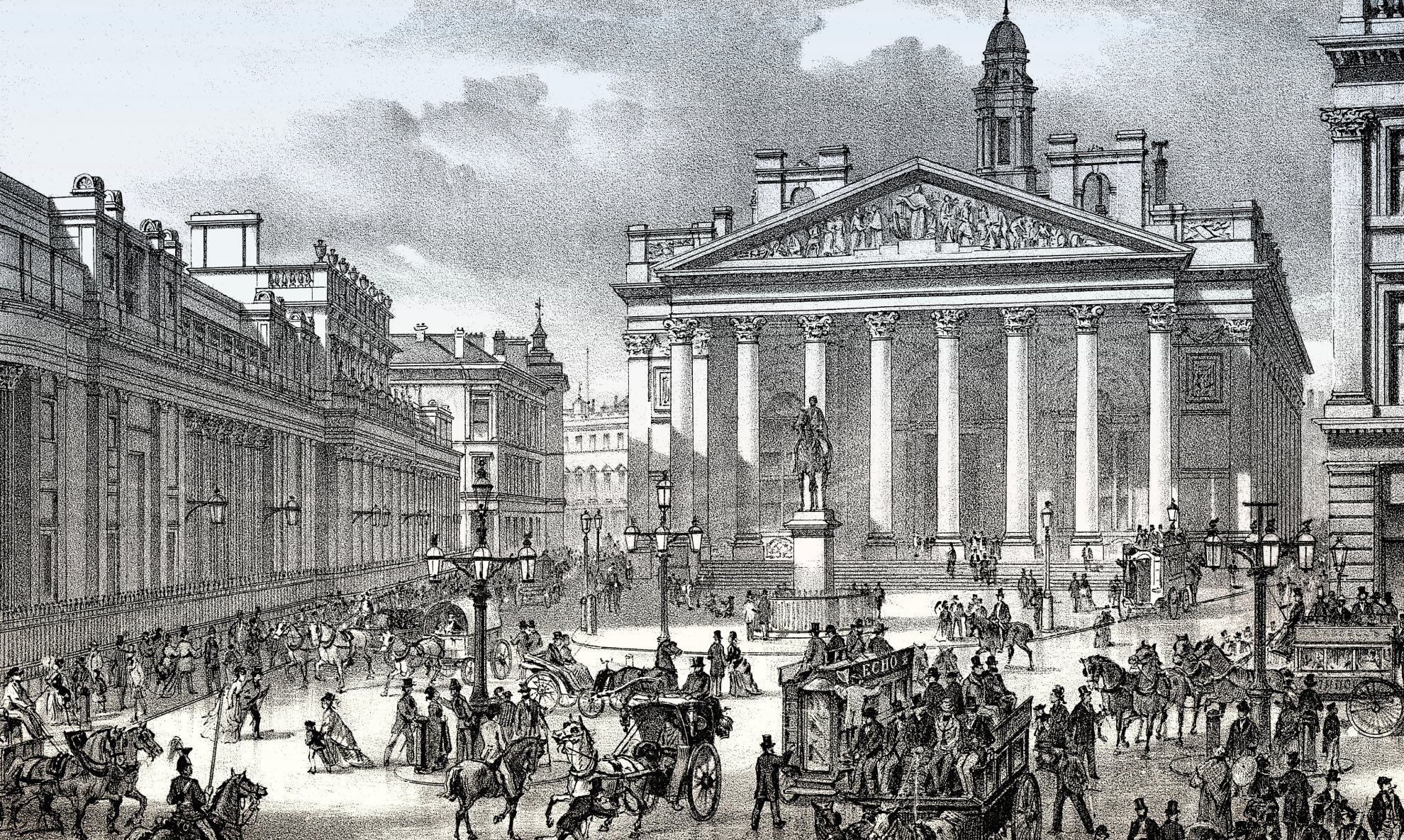

Schroders' global history – two centuries of investing for the future

Founded in London in 1800 as J.F.Schröder & Co, our first 100 years saw us building a client base around the world. We were busy financing trade between America and Europe and funding major infrastructure projects like railways, ports and power stations. And moving into new areas such as bonds and corporate finance.

In 1924, we formed our first investment trust and started managing investments for clients. Our listing on the London Stock Exchange followed in 1959.

By the start of the 20th century, we had clients across the Americas, Europe and Asia. Come the 1970s, we had a presence in the major financial markets, including Hong Kong, Japan, Singapore, Australia, Brazil, Switzerland and many more.

In 2000, we sold our investment banking arm to specialise in asset and wealth management. Today, we’ve also expanded into private markets, opening up a new dimension to our clients.