Sustainable Investing Capabilities

Schroders is focused on helping clients with their long-term financial and sustainable investment goals.Key Highlights

Our philosophy

Rigorously assessing financially material ESG-related investment factors could lead to improved outcomes for all stakeholders:

- Effectively manage portfolio risk and identify growth opportunities

- Identify sustainable business models which are more resilient in the long term

Aligning our investments with the financial and sustainability objectives of our clients is key.

Investments in our growth

Impact investing

Majority stake in BlueOrchard, a leading global impact investor

Renewables

75% shareholding in Greencoat Capital, now Schroders Greencoat, a leading renewable infrastructure manager

Natural Capital

Investment in NatCap Research to accelerate the development of its online platform to map natural capital assets globally. Partnership with Conservation International: Akaria Natural Capital established to invest in natural capital projects

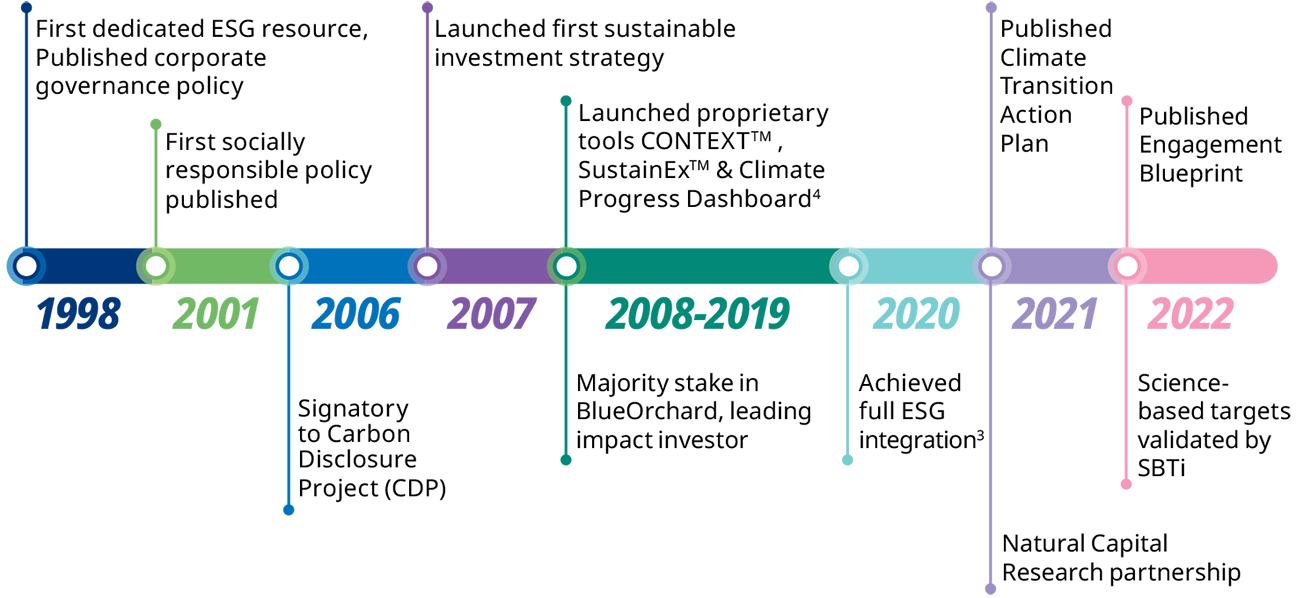

Our timeline: continuously evolving capabilities

Energy Transition

The mega-trend towards decarbonization is accelerating the energy transition globally.

Source: Schroders.

- For certain businesses acquired during the course of 2020, 2021 and 2022 we have not yet integrated ESG factors into investment decision-making. There are also a small number of strategies for which ESG integration is not practicable or now possible, for example passive index tracking or legacy businesses or investments in the process of or soon to be liquidated, and certain joint venture businesses are excluded. As a result of these exceptions full ESG integration should not be interpreted as 100% integration of all assets.

- NMG Global Institutional Brand Ranking, 2023 (3rd place in North America).

- Environmental Social & Governance (ESG) Integration means that certain ESG risk were considered in the evaluation of the investment made and does not guarantee that a particular ESG outcome will be achieved.

- Schroders uses SustainEx™ to estimate the net social and environmental “cost” or “benefit” of an investment portfolio having regard to certain sustainability measures in comparison to a product’s benchmark where relevant. It does this using third party data as well as Schroders own estimates and assumptions and the outcome may differ from other sustainability tools and measures. CONTEXTTM is a proprietary tool used by Schroders to support the analysis of companies’ and issuers’ management of the environmental, social and governance trends, challenges and opportunities that Schroders believes to be most relevant to that company’s or issuer’s industry. It provides access to a wide range of data sources chosen by Schroders. Any views or conclusions integrated into Schroders’ investment-decision making or research by fund managers or analysts through the use of CONTEXTTM will reflect their judgement of the sustainability of one or more aspects of the relevant company’s or issuer’s business model rather than a systematic and data-driven score of the company or issuer in question. The Climate Dashboard solely reflects data from MSCI and does not display any results that has been influence by any Schroders proprietary analytical process.